Looking Good Tips About How To Control Cash Flow

Understand who you are doing business with.

How to control cash flow. The first and most important tip is to keep close track of your cash flow at all times. Cash flow is the movement of money in and out of a company. How can cash receipts be controlled?

Best practices for effective cash flow management. Start out the right way! Effective credit control:

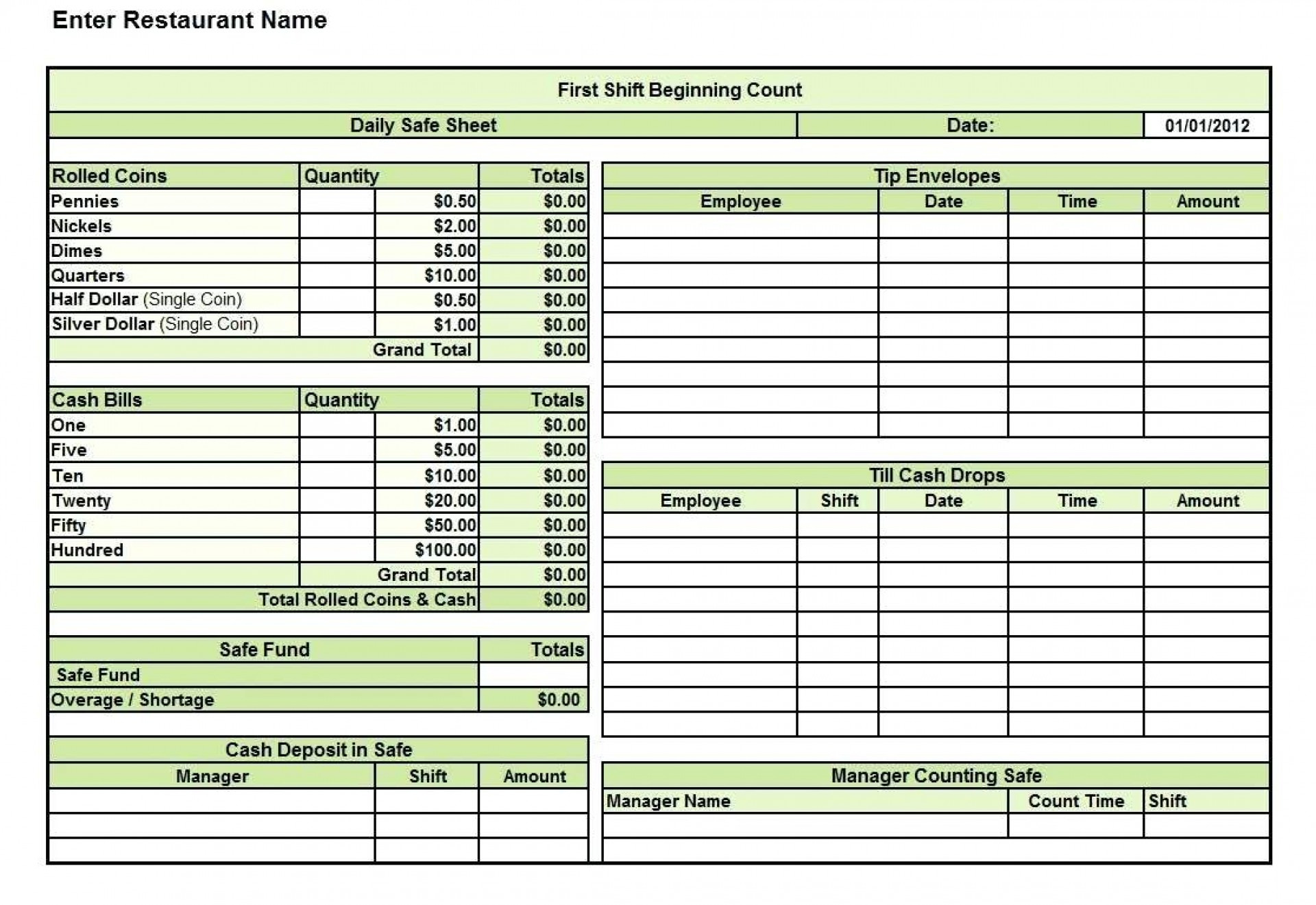

Monitor your existing portfolio of customers and changes in their payment. Safeguarding cash and cash equivalents in secure locations. How to improve your cash flow in 5 steps.

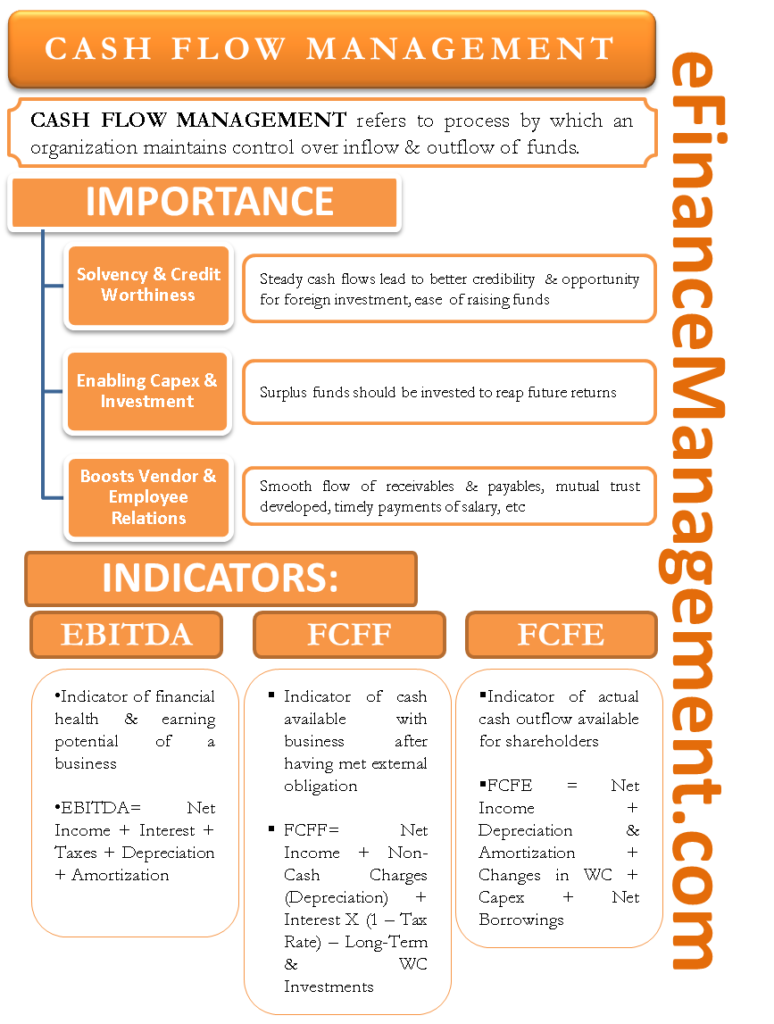

When you have positive cash flow, you have more cash coming into your business than you have leaving it—so you can pay your bills and cover other expenses. What is cash flow management, and what does its process entail? But first, its important to understand the concept itself.

To achieve certainty, you need to: Obtaining employee bonding insurance, requiring background checks. Learn how to manage your cash flow with these 10 tips.

Find better deals for business services. To calculate your average, determine your accounts receivable at the beginning of the quarter. Project cash flow management measures, monitors, and controls cash flow for a project or phase.

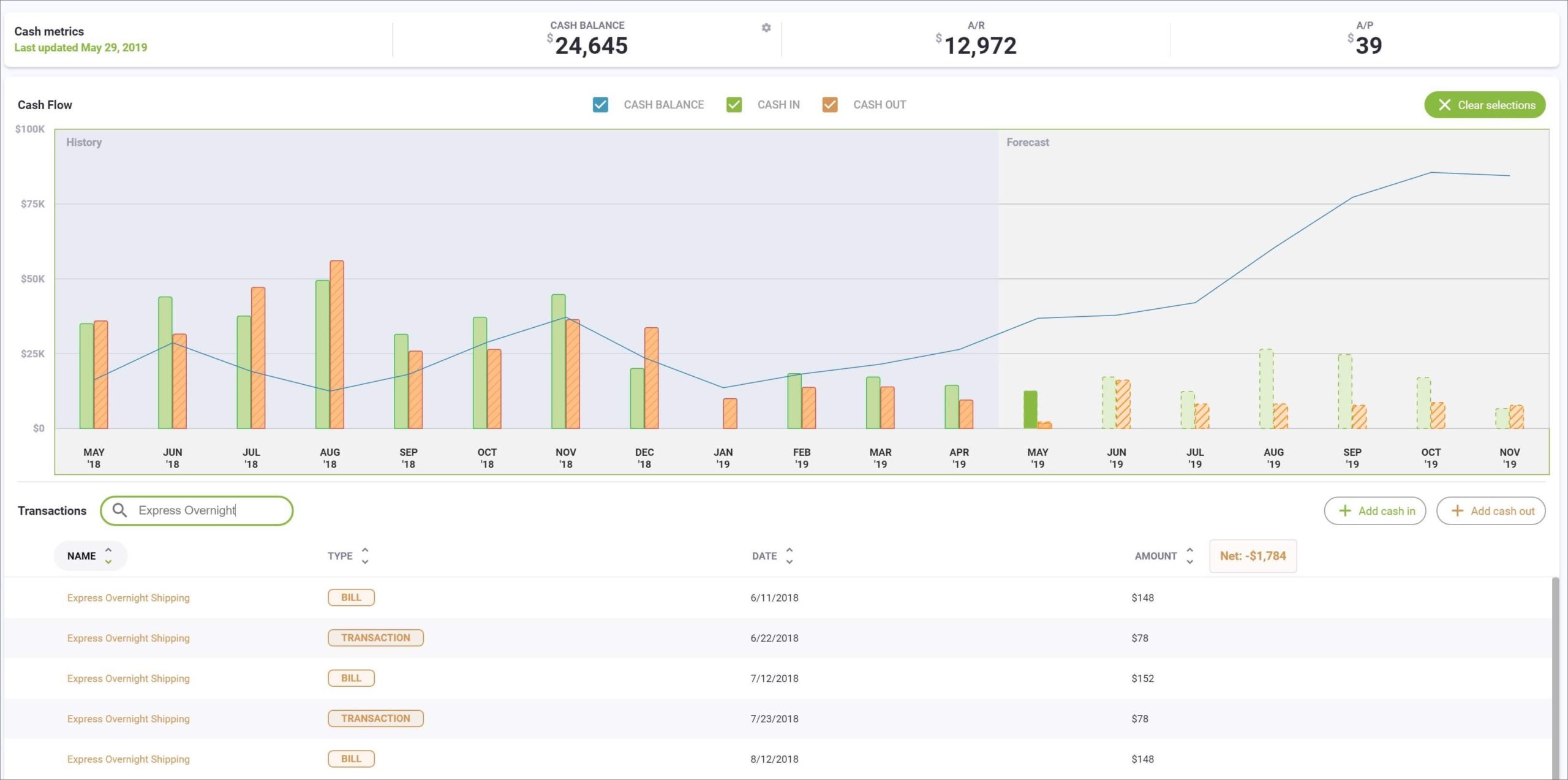

What is cash flow? Cash flow management + cash flow analysis + cash flow projection = cash flow control. Keep close track of cash flow.

Cash flow management is essentially keeping track of that flow and analysing changes. Think of it as an analysis of the expected inflow and outflow. Use financial tools and reports to keep an eye on your cash flow and make better decisions about money.

It can systematically influence cognitive control, which is crucial. Understanding cash sources and where your cash is going is essential for maintaining a financially sustainable business. Then determine your accounts receivable at the end of the quarter.

Cash received signifies inflows, and cash spent is outflows. To do this, you need to have cash flow control. Schedule time for your finances.

![14 tips for controlling cash flow [cheat sheet]](https://blog.jpabusiness.com.au/hs-fs/hubfs/14 tips to control cash flow.png?width=756&name=14 tips to control cash flow.png)

![Grow Your Business Efficiently With QuickBooks Desktop [Guide]](https://www.hostdocket.com/wp-content/uploads/2019/04/Control-Cash-Flow-Screenshot-1024x640.jpg)