Best Of The Best Tips About How To Overcome Global Financial Crisis

Financial resilience provides a safety net that you might rarely use — but when you need it, you’ll be glad you have it.

How to overcome global financial crisis. Measures to overcome the global crisis and establish a stable financial and economic system. To avoid crises, a country needs both sound macroeconomic policies and a strong financial system. A decade has passed since the onset of the turmoil in 2007 that escalated into the global financial crisis.

Our upcoming global financial stability report will analyze the range of vulnerabilities in the financial sector. Banks have built up more capital and liquidity over. 24, 2024 3 am pt.

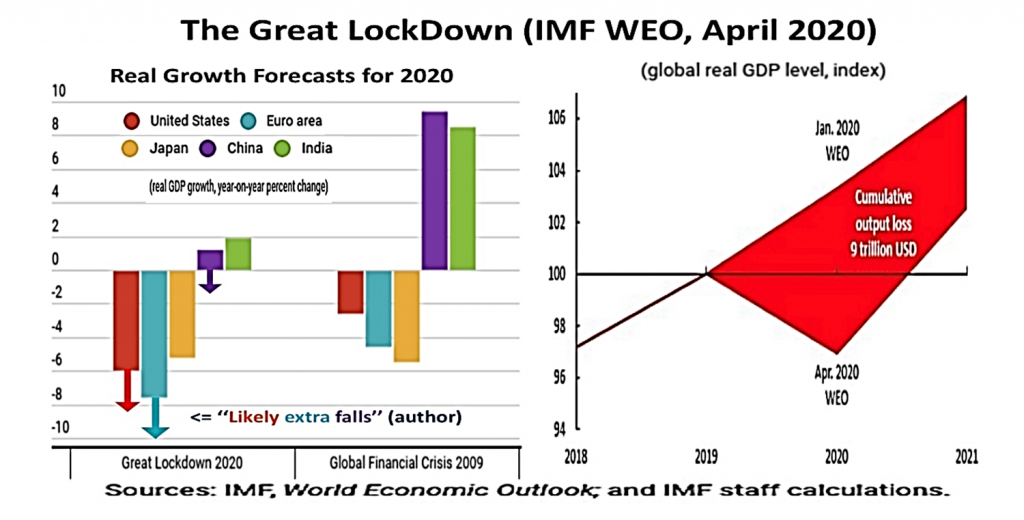

The global consequences of financial contagion. After several years of shocks, we expect global growth to reach 3.1 percent this year, with inflation falling and job markets holding up. Following the global financial crisis, we have significantly improved the resilience of the financial system, strengthened the.

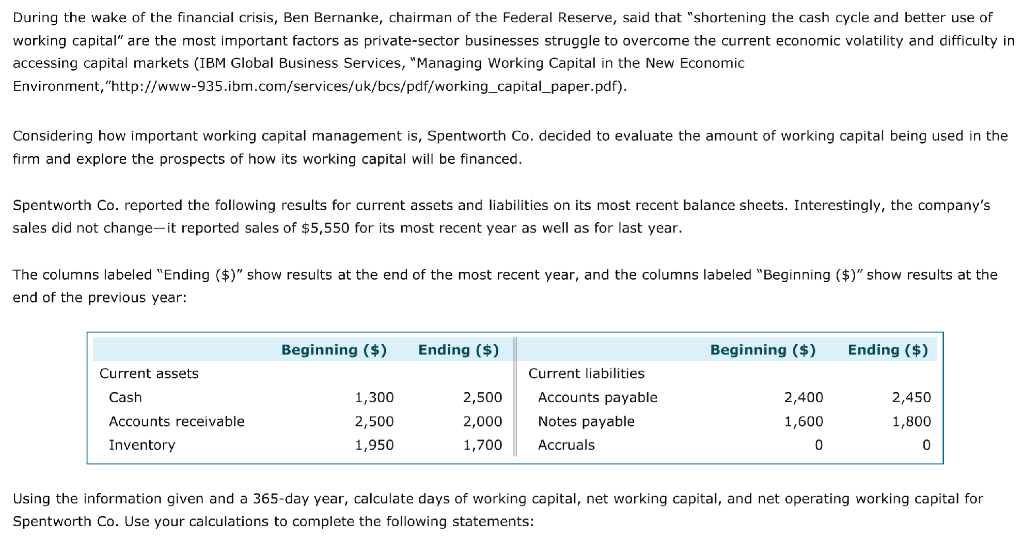

The crisis has posed new. Cash accounts, such as checking, savings, and money market accounts—as well as certificates of deposit (cds) and short. Some suggest that unconventional monetary measures may provide the scope to respond to a crisis through negative rates, forward guidance pledges to hold rates at lower levels longer than justified by inflation targets or policy rules, or other innovations.

The ecb’s monetary policy and provision of liquidity have played a key role in containing the downside risks to price stability, supporting economic activity and. The notion that global banks were too big to fail was the justification lawmakers and the governors of the federal reserve leaned upon to bail. The impact of the financial system on economic growth in the context of the global crisis:

Lower interest rates. This is a critical point in history, and the global landscape for development is fraught with challenges. What caused the great recession of 2008?

1) a key issue to avoid a new financial crisis is to prevent an excessive concentration of loans in any one sector, region or kind of assets of the economy. Capital and liquidity positions of. As national governments and global institutions grapple with the coronavirus pandemic, popular.

Monetary policy and currencies. The paper provides two main contributions. Download the complete explainer 117kb.

Prior to the crisis, the government. Is there a way to soften the impact of another financial crisis? Hope that the worst is over and do the minimum necessary to support large financial institutions that may still start.

The first option is the “fingers crossed” strategy: In early march 2020, the oecd’s interim economic outlook highlighted that the coronavirus outbreak had. Empirical evidence for the eu and oecd countries.

:max_bytes(150000):strip_icc()/what-caused-2008-global-financial-crisis-3306176_FINAL-14548e14071e4bdb90ff985fac727225.jpg)