Perfect Info About How To Start A Real Estate Investment Trust

There’s multiple different ways to invest in real estate investment trusts, ranging from publicly traded reits to.

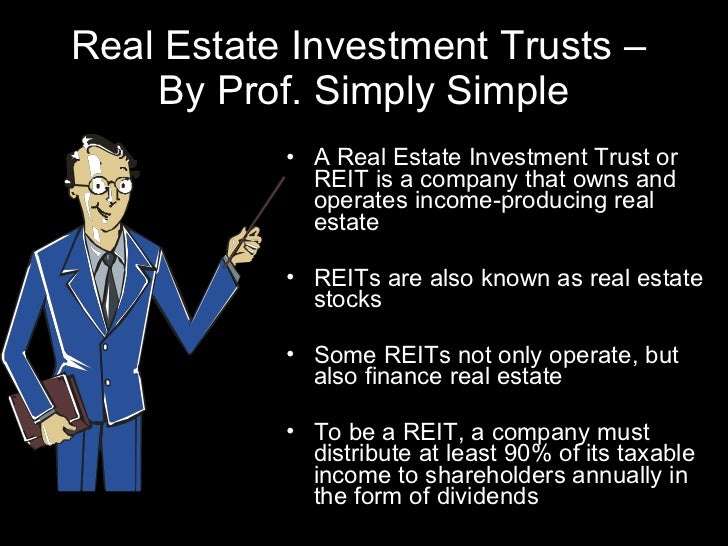

How to start a real estate investment trust. Invest in 2,800+ stocks and other assets including 70+ cryptocurrencies and commodities. A real estate investment trust (reit, pronounced “reet”) is a security that directly invests in real estate, by buying and selling property much like stocks on. Read on to get all the information you need, so you can start your own trust with confidence.

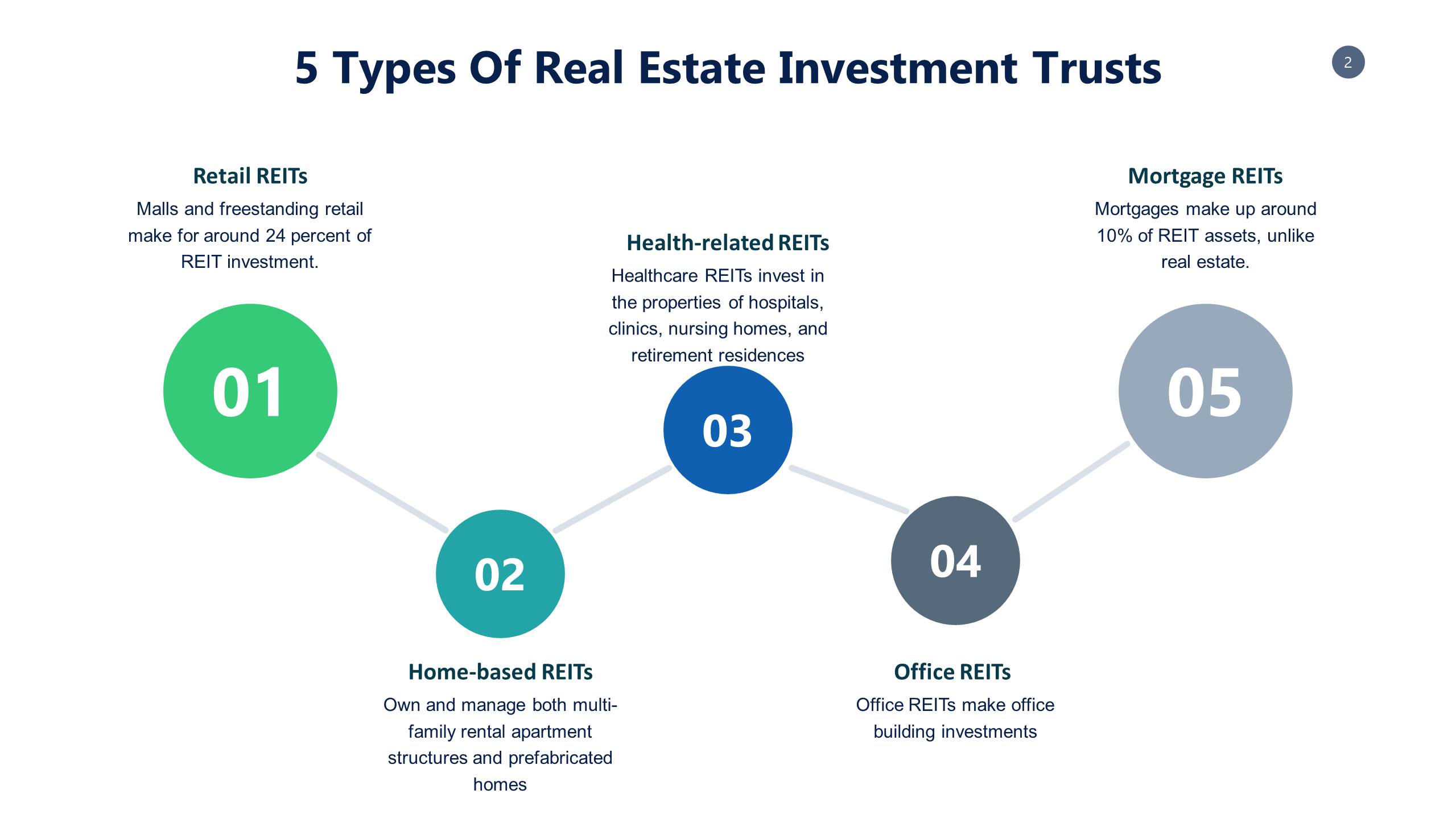

Pick a type first, you must decide what type of reit you want to form. Often compared to mutual funds, they're. You can read more about investment trusts here.

If you're interested in starting a real estate investment trust (reit) but don't know where to begin, this comprehensive guide is here to help. What is a real estate investment trust? Investors who want to access real estate can, in turn, buy shares of a reit and through that share ownership effectively add the real estate owned by the reit to their investment portfolios.

Find out how to apply to be a uk real estate investment trust if you're a company or group of companies who invests in properties. Throughout history, property values have increased over time. As with all investment trusts, reits can trade at a discount or a premium to their net asset value (nav).

Reits or real estate investment trusts are shares of real estate companies investors can buy. Here’s what you need to do to start a real estate investment trust: How to get started with investing in real estate:

This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or. A real estate investment trust. You can invest in a reit by purchasing shares.

How to invest in real estate investment trusts (reits) home investing in reits individuals can invest in reits in a variety of different ways, including purchasing. One of the key ways. Modeled after mutual funds, reits pool the capital of numerous investors.

By investing in reits, investors indirectly invest in real estate. Start by defining your financial goals and what you want to achieve with your real estate. How to invest in real estate investment trusts.

There are five steps to setting up a real estate investment trust: Quarterly, at least 75% of a reit's assets must consist of real estate assets such as real property or loans secured by real property. Learn about how they work and if they're right for you.

Choose a type the first thing you need to do when setting up a reit is to pick a type.